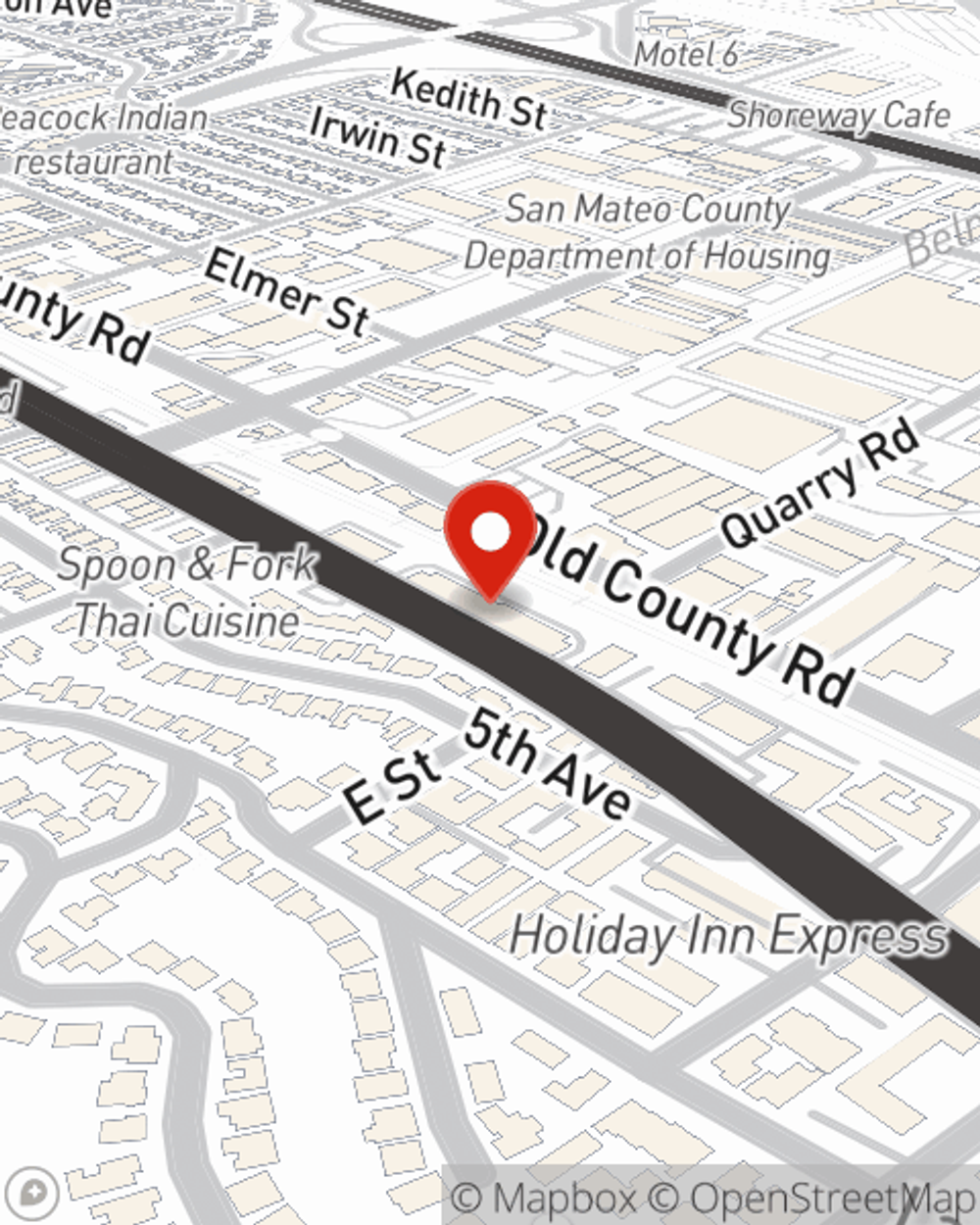

Business Insurance in and around Belmont

Belmont! Look no further for small business insurance.

Cover all the bases for your small business

- the Peninsula

- California

- the Bay Area

- San Mateo County

- Belmont

- San Carlos

- Redwood Shores

- Redwood City

- San Mateo

- Foster City

- Burlingame

- Hillsborough

Coverage With State Farm Can Help Your Small Business.

Sometimes the unpredictable is unavoidable. It's always better to be prepared for the unfortunate accident, like an employee getting hurt on your business's property.

Belmont! Look no further for small business insurance.

Cover all the bases for your small business

Cover Your Business Assets

The unexpected is, well, unexpected, but that's all the more reason to be prepared. State Farm has a wide range of coverages, like business continuity plans or extra liability, that can be formed to develop a personalized policy to fit your small business's needs. And when the unexpected does happen, agent Jim Dwyer can also help you file your claim.

Don’t let concerns about your business stress you out! Reach out to State Farm agent Jim Dwyer today, and learn more about how you can benefit from State Farm small business insurance.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

Jim Dwyer

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.